Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Watches worth the investment aren’t just accessories—they’re statements of timeless style and smart financial sense. Imagine slipping on a timepiece that doesn’t just tell time—it tells your story. The gentle weight on your wrist, the subtle glint catching the light, and the envious glances it draws. In a world of fast fashion and fleeting trends, investing in an elegant watch is a declaration of enduring taste.

If you’ve ever dreamed of owning something that grows in value while enhancing your personal style, you’re about to discover the 3 elegant watches worth the investment.

Luxury watches are more than just accessories; they are heirlooms, status symbols, and appreciating assets. Here’s why:

Whether you’re new to watch collecting or refining a seasoned collection, a carefully chosen timepiece can be one of the wisest investments you’ll ever make.

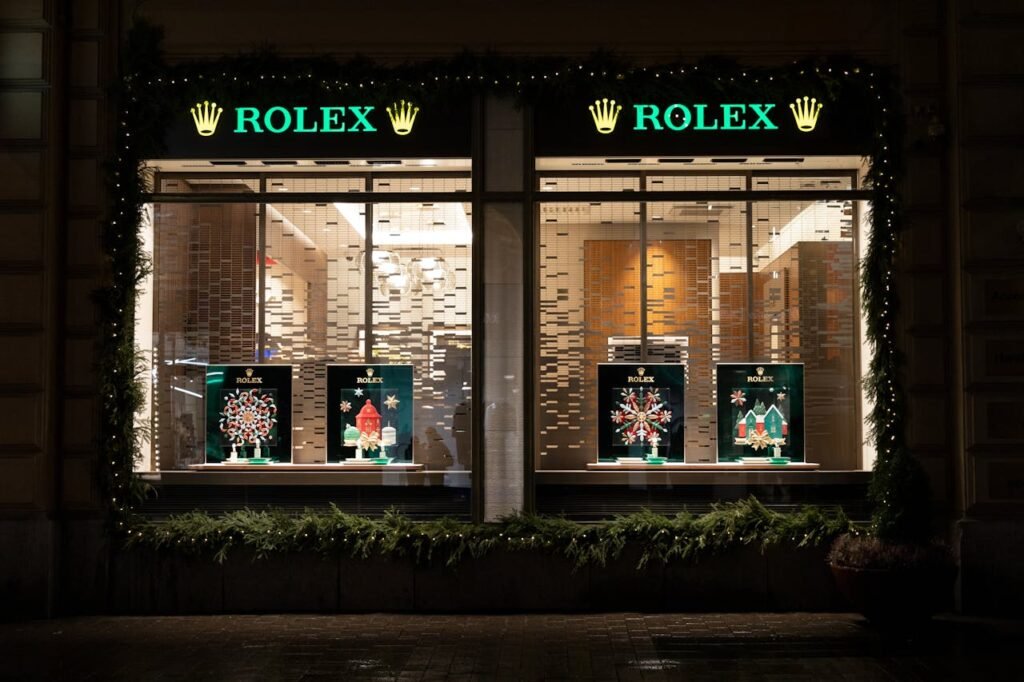

Few watches embody prestige and performance like the Rolex Daytona. Originally designed for professional racecar drivers, today it’s a cultural icon.

Fun Fact: A Paul Newman Daytona sold for over $17 million—one of the most expensive watches ever auctioned!

The Patek Philippe Nautilus is a masterpiece of understated elegance. Designed in 1976 by the legendary Gérald Genta, it remains one of the most sought-after luxury watches.

Insight: A Nautilus ref. 5711/1A-010 was recently auctioned for over six times its retail price.

When the Royal Oak debuted in 1972, it shattered conventions. It was the world’s first luxury sports watch made of steel—and today, it’s a collector’s dream.

Tip: Early Royal Oak models (like the “Jumbo”) have become some of the most prized vintage watches globally.

| Watch Model | Notable Feature | Investment Reason | Estimated Entry Price |

|---|---|---|---|

| Rolex Daytona | Chronograph Mastery | Limited production; cultural prestige | $15,000+ |

| Patek Philippe Nautilus | Slim Porthole Design | Ultra-exclusive; appreciating asset | $70,000+ |

| Audemars Piguet Royal Oak | Steel Sport Luxury | Game-changing design; rarity | $35,000+ |

Buying your first investment watch is thrilling, but it demands careful consideration. Here’s a checklist to guide you:

Why do luxury watches hold their value?

High demand, limited supply, superior craftsmanship, and strong brand recognition all contribute to value retention.

Is it better to buy new or vintage investment watches?

Both have merits! New models offer warranty and condition guarantees, while vintage pieces can offer more dramatic price appreciation.

How often should I service an investment watch?

Experts recommend servicing every 3-5 years to maintain optimal function and value.

Can I wear my investment watch daily?

Yes—but with care. Regular use won’t harm the watch if maintained properly, but avoid harsh conditions.

Where is the safest place to store a luxury watch?

A secured safe, preferably climate-controlled, protects your investment from theft and environmental damage.

Investing in an elegant watch is about more than just money—it’s about owning a piece of art that tells time and history simultaneously. Each tick is a reminder that true luxury doesn’t fade; it grows richer.

Whether you choose the daring Royal Oak, the iconic Daytona, or the distinguished Nautilus, you’re not just buying a watch—you’re securing a legacy.

If you found this guide insightful, share it with a fellow watch enthusiast or explore more luxury lifestyle tips on our blog!